4 Simple Techniques For Amur Capital Management Corporation

4 Simple Techniques For Amur Capital Management Corporation

Blog Article

4 Simple Techniques For Amur Capital Management Corporation

Table of Contents3 Easy Facts About Amur Capital Management Corporation DescribedMore About Amur Capital Management Corporation7 Simple Techniques For Amur Capital Management CorporationFascination About Amur Capital Management CorporationThe Of Amur Capital Management CorporationSome Known Facts About Amur Capital Management Corporation.

Foreign straight investment (FDI) happens when an individual or business possesses a minimum of 10% of a foreign firm. When financiers have much less than 10%, the International Monetary Fund (IMF) specifies it just as part of a supply portfolio. Whereas a 10% ownership in a business doesn't provide a specific investor a controlling interest in a foreign firm, it does enable impact over the firm's management, operations, and general policies.Companies in creating nations require international financing and proficiency to increase, offer framework, and assist their global sales. These foreign business require personal investments in framework, energy, and water in order to boost tasks and salaries (passive income). There are numerous degrees of FDI which vary based on the kind of business included and the reasons for the investments

How Amur Capital Management Corporation can Save You Time, Stress, and Money.

Various other forms of FDI consist of the procurement of shares in an associated enterprise, the unification of a wholly-owned business, and engagement in an equity joint endeavor across worldwide limits (https://www.pageorama.com/?p=amurcapitalmc). Investors that are planning to engage in any type of type of FDI might be important to evaluate the financial investment's benefits and negative aspects

FDI enhances the production and solutions sector which causes the development of jobs and helps to decrease joblessness prices in the country. Raised employment translates to greater incomes and furnishes the populace with more purchasing power, improving the general economy of a nation. Human funding involved the understanding and competence of a workforce.

The production of 100% export oriented devices assist to help FDI capitalists in improving exports from various other nations. The flow of FDI right into a country translates into a continuous circulation of forex, helping a nation's Central Financial institution keep a thriving book of foreign exchange which causes stable currency exchange rate.

The Main Principles Of Amur Capital Management Corporation

International direct financial investments can in some cases influence exchange prices to the benefit of one country and the hinderance of another. When capitalists invest in international counties, they might see that it is a lot more expensive than when products are exported.

Thinking about that international straight investments may be capital-intensive from the point of view of the financier, it can occasionally be extremely risky or financially non-viable. Many third-world countries, or at least those with history of manifest destiny, fret that foreign straight investment would certainly result in some kind of contemporary financial manifest destiny, which exposes host nations and leave them vulnerable to foreign business' exploitation.

Stopping the achievement gap, boosting health outcomes, increasing incomes and supplying a high rate of economic returnthis one-page document summarizes the advantages of spending in top quality very early childhood years education and learning for deprived kids. This document is commonly shown to policymakers, supporters and the media to make the instance for very early youth education.

All About Amur Capital Management Corporation

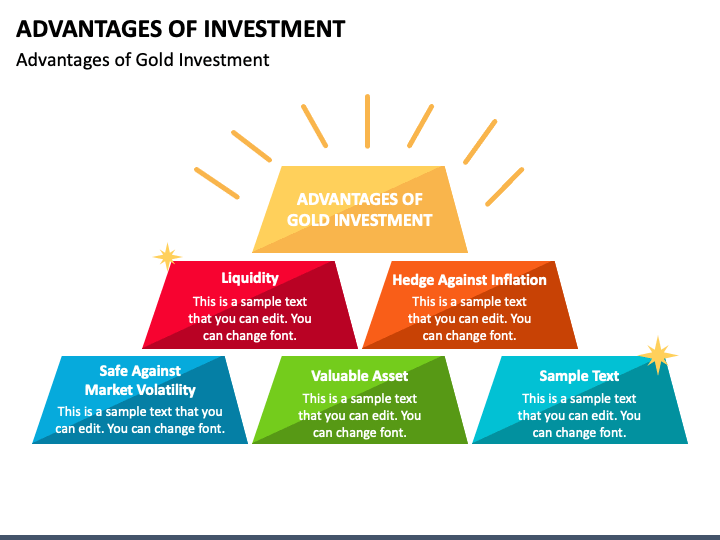

Think about how gold will certainly fit your financial objectives and long-lasting financial investment plan prior to you invest - investment. Getty Images Gold is typically thought about a solid possession for and as a in times of unpredictability. The rare-earth element can be appealing with durations of financial uncertainty and economic downturn, as well as when rising cost of living runs high

Getting My Amur Capital Management Corporation To Work

"The excellent time to construct and allot a model profile would certainly remain in much less moved here unstable and difficult times when emotions aren't managing decision-making," says Gary Watts, vice president and financial advisor at Wide range Improvement Team. After all, "Seafarers clothing and arrangement their boats before the tornado."One method to determine if gold is best for you is by researching its advantages and disadvantages as a financial investment option.

So, if you have cash money, you're properly shedding money. Gold, on the various other hand, may. Not every person concurs and gold might not constantly climb when rising cost of living goes up, yet it could still be a financial investment factor.: Purchasing gold can possibly help capitalists survive unsure financial conditions, taking into consideration the during these durations.

Amur Capital Management Corporation - Truths

That doesn't mean gold will certainly always rise when the economy looks unsteady, yet it can be great for those who intend ahead.: Some investors as a way to. As opposed to having all of your cash tied up in one asset class, various might possibly aid you better take care of risk and return.

If these are a few of the advantages you're seeking after that start purchasing gold today. While gold can help include balance and safety for some financiers, like most investments, there are likewise risks to look out for. Gold might outpace other possessions throughout specific durations, while not standing up too to lasting cost gratitude.

Report this page